Qualifying for lmi means passing an insurance companys qualification guidelines as well as a lenders home loan application criteria. The two parts of fha mortgage insurance.

5 Types Of Private Mortgage Insurance Pmi

what is mortgage insurance on a home loan

what is mortgage insurance on a home loan is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in what is mortgage insurance on a home loan content depends on the source site. We hope you do not use it for commercial purposes.

The mortgage insurance programme mip was launched by the hong kong mortgage corporation limited hkmc in march 1999 for promoting home ownership in hong kong.

What is mortgage insurance on a home loan. Youre going to pay lenders mortgage insurance on the loan. So what is it. Depending on the size of your home loan deposit you may have to pay lenders mortgage insurance lmi.

The traditional target for a home down payment is 20 of the purchase price but thats out of reach for many buyers. Because it is actually the mortgage insurance company taking the risk on your home loan they may have stricter criteria for granting approval. Lenders mortgage insurance calculator.

Mortgage insurance for fha loans comprises two parts. When lenders approve a home loan they are effectively taking a risk on whether the amount borrowed will be repaid. The mip business has been transferred to and carried out by hkmc insurance limited hkmci a wholly owned subsidiary of the hkmc with effect from 1 may 2018.

What about lender mortgage insurance. However you are only required to pay fha mortgage insurance if your down payment is less than 20 or you are refinancing a home with less than 20 equity. How much does it cost.

Youll most likely have to pay mortgage insurance if you make a down payment thats less than 20 percent of the homes purchase price. So what is it. This calculator can show you how much lmi youll be paying over the course of the mortgage.

Mortgage insurance is an insurance policy that protects a mortgage lender or title holder in the event that the borrower defaults on payments dies or is otherwise unable to meet the contractual. Mortgage insurance makes it possible to hand over a much. A mortgage insurance premium is the monthly payment you make for your mortgage insurance policy which protects your lender if you stop making payments on your home loan.

Borrowers with smaller deposits under 20 of a propertys value usually have to pay it. Lender mortgage insurance lmi is a policy that is paid for by the home buyer but protects the lender from financial loss should you default on loan payments. Lenders mortgage insurance lmi protects your lender if you cant repay your mortgage.

Lmi can cost. The upfront mortgage insurance premium and the annual mortgage insurance premium. Depending on the size of your home loan deposit you may have to pay lenders mortgage insurance lmi.

Borrowing more than 80 of the purchase price of your home.

What Is Mortgage Insurance U S Mortgage Insurers

Mortgag E Insurance What Is Mortgage Insurance Also Known As

Mortgag E Insurance What Is Mortgage Insurance Also Known As

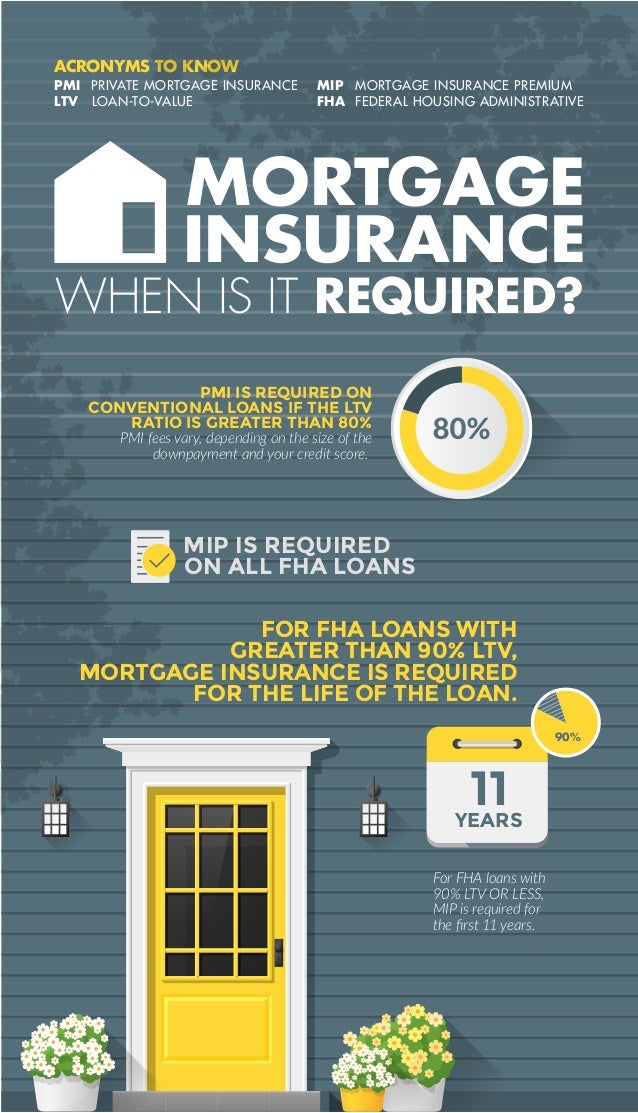

Mortgage Insurance When Is It Required

Mortgage Insurance When Is It Required

What You Need To Know About Private Mortgage Insurance Pmi

What You Need To Know About Private Mortgage Insurance Pmi

Do Mortgage Companies Pocket The Mortgage Insurance Paid To Them

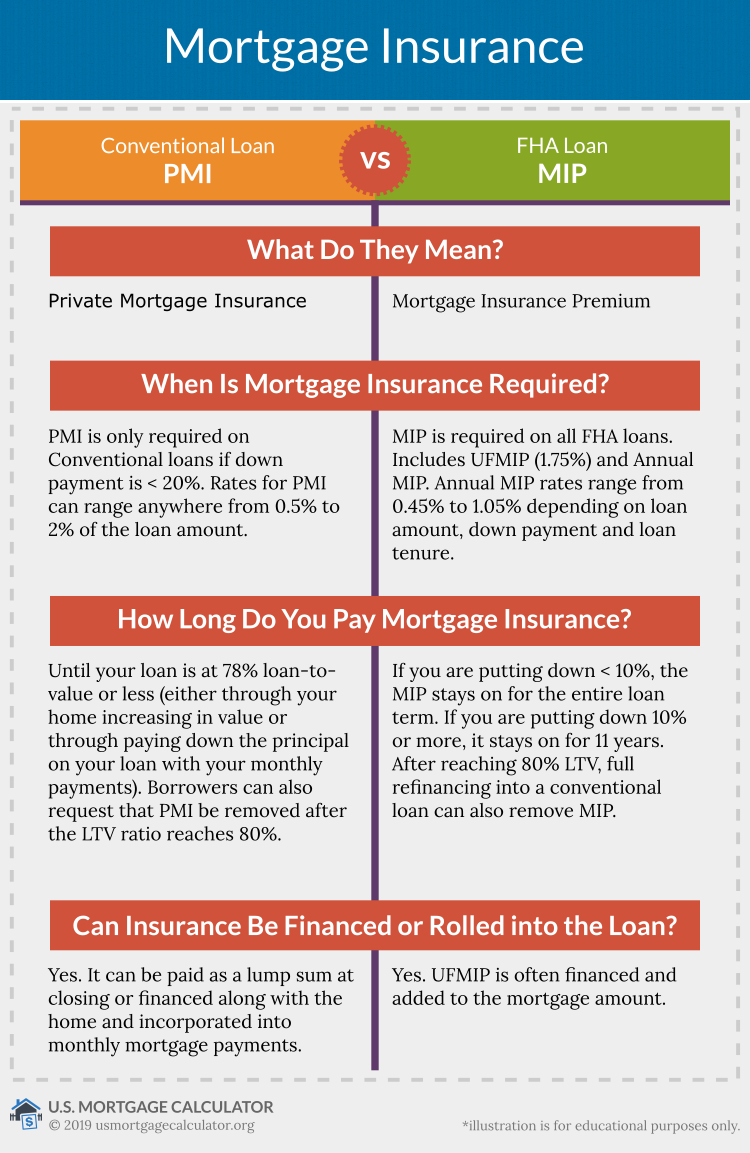

Private Mortgage Insurance Pmi Faq U S Mortgage Calculator

Private Mortgage Insurance Pmi Faq U S Mortgage Calculator

Government Insured Loans 4 Advantages That Make Them Different

Government Insured Loans 4 Advantages That Make Them Different

Affordable Mortgage Insurance Policy To Guard Your Abode

Affordable Mortgage Insurance Policy To Guard Your Abode

Fha Mortgage Insurance Explained

Fha Mortgage Insurance Explained

Infographic What Do Mortgage Lenders Look For When Approving A

Infographic What Do Mortgage Lenders Look For When Approving A

Adverse Credit Mortgages Advantages Of Bad Credit Mortgages

Adverse Credit Mortgages Advantages Of Bad Credit Mortgages